Can California Courts Divide my retirement?

The treatment of retirement plans under California divorce law can be daunting and requires planning. This article concerns the division of retirement benefits and plans in a California Divorce. It outlines the divorce process. The parties may also consider Social Security benefits.

An attorney should be consulted with regard to treatment of a retirement asset. Retirement plans will often be the most valuable asset a couple has next to a house. Without proper treatment of retirement accounts, a court may not be able to enter a divorce judgment. This will result in frustration for the divorcing parties. Furthermore, mistreatment of plans may result in needless extra taxes.

Under California community property laws, interest or income accumulated in a 401(k), pension plan, government pension plan, or profit-sharing plan during the marriage is community property. This includes contributions made to a pension and service credit accrued during the marriage. In addition, this will include stocks, stock option plans, and other marital property and debts.

While property that is considered separate property belongs to the spouse who owns it prior to marriage, property that is community property will be divided in half between the parties. The same division applies to community debts. Typically, retirement plans and accounts cover a spouse’s employment before marriage and after separation. In addition, if a spouse retires during the marriage, he or she may be receiving benefits now or in the near future. This presents complexity in the calculation of retirement benefits.

How Is A Retirement Plan Divided?

Dividing the community portion of retirement accounts will depend on the type of retirement plan involved.

Division of Property under QDROs for qualified pensions and 403(b) plans

What is a QDRO?

A Qualified Domestic Relations Order (QDRO) is a court order obtained in a California divorce court which affects retirement plans. These include plans that are subject to and meet ERISA guidelines. The types of plans generally include employer-sponsored retirement accounts, 401(k) accounts, and pensions.

Is a QDRO needed for all types of retirement accounts or plans?

QDRO’s are needed for plans that meet ERISA guidelines. They do not apply to all retirement plans. They apply only to ERISA plans, such as 401(k) accounts.

Does my plan need to be joined in the divorce proceeding?

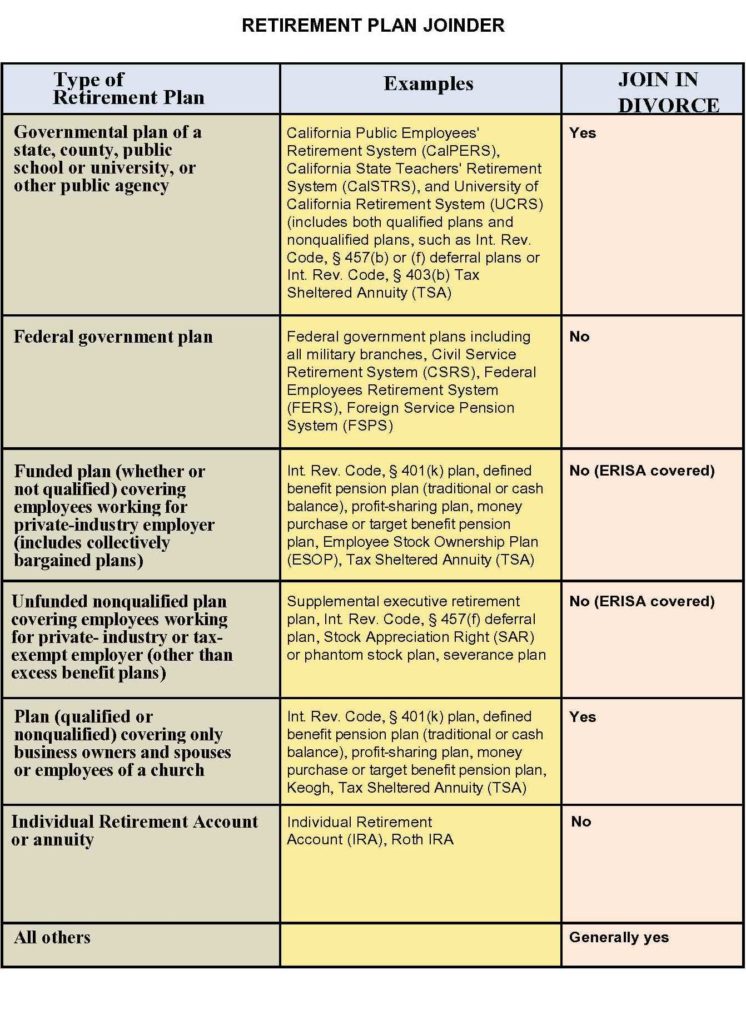

To determine if your plan is required to be divided by QDRO, California provides a recommend a list of retirement accounts which should be added to the divorce and accounts which do not need to be. In other words, the retirement plan will need to be “joined” to the divorce proceeding. The plan becomes a party to the divorce proceeding and will have to file a response. Joining the plan is not usually adversarial in nature. It is an administrative requirement.

How do I join my pension plan as a party to the divorce?

The following forms must be filed with the court and served on the retirement plan. This will join the plan as a party to the divorce:

1. Request for Joinder of Employee Benefit Plan and Order (FL-372)

2. Pleading on Joinder—Employee Benefit Plan (FL-370)

A QDRO order is used to divide your retirement plans. It instructs the plan administrator of your retirement plan how division or assignment of retirement payments to your spouse or dependents is to happen.

For instance, a QDRO may order the plan administrator to pay $250 of $500 in pension benefits to the non-employee spouse as his or her community share , who is called the “alternate payee.” The court may order the same benefits be paid to the alternate payee as an spousal support.

The couple’s prenuptial agreement can tackle the dispute in retirement benefits and help protect the retirement benefits of one or both spouses. Learn more about prenuptial agreements.

Who Should Prepare the QDRO?

Your attorney should draft a QDRO or collaborate with the retirement plan administrator or another expert to ensure the proper division of benefits. Often, the retirement plan administrator can determine with specificity the level of payments to be divided between the employee and his or her alternate payee spouse. Furthermore, the administrator can readily identify the terms of the retirement plan. This can be an involved process.

Cashing out your spouse’s community interest in your retirement

If the plan is not an ERISA qualified plan as above, the community portion of the retirement plan may be valued and replaced with another asset. This allows the retirement plan to remain with the employee spouse. Taxes will be minimized. The non-employee (also known as “alternate payee”) spouse will receive an equivalent value, which California courts require in order to approve the divorce judgment.

The problem that occurs is when benefits under the retirement plan will not be payable for many years. Thus, time becomes an element. The benefits will need to be given a present value to determine the appropriate cash offset. The present value figure will be an approximation at best based upon interest rates and other economic factors. “Defined Benefit” plans are very hard to value because this type of retirement plan only pays when a spouse retires (in many years) and starts to receive benefits. The spouse’s life expectancy will be taken into account. Until then, these benefits have no value. A “Defined Contribution” plan, such has an IRA, has a present cash value for the employee spouse which can be valued for offset purposes.

Nonetheless, it is a viable alternative to divide a couple’s retirement plans in a divorce.

Cash Division of plans directly

The parties may agree to divide the asset, such as an IRA or other non-ERISA plan, directly.

As an example, contributions to an IRA may total $25,000 during the marriage. The parties may, therefore, agree to an equal division. However, the alternate payee will have to roll the funds over to another IRA or be subject to tax and tax penalties for early withdrawal. If that spouse is not concerned with the tax, then this may be a viable solution. The divorce decree will describe the cash division of the IRA or other non-ERISA plan.

Need for Legal Counsel

Experienced legal counsel should be consulted before division of retirement benefits, accounts, and plans. First, this is because often these are among a couple’s biggest assets in a divorce. They also may require a QDRO which will require an attorney (along with the plan administrator) to draft. Second, there are substantial tax ramifications that the couple should consider. Third, you will be frustrated if the division of retirement plan assets is mishandled in your divorce. You will also pay more in taxes. Fourth, this is a complicated area of the law. In conclusion, Attorney Keith F. Carr has over 30 years experience in divorce law and dividing retirement assets. He has special knowledge of California’s property division laws regarding retirement plans.

Keith F. Carr is an attorney practicing Divorce, Estate Planning, and Bankruptcy. Attorney Keith F. Carr has over 30 years experience. Founder of Law Offices of Keith F. Carr, located in San Francisco, San Jose, and Palo Alto, Ca.